crypto tax calculator nz

Check out our free guide on crypto taxes in New Zealand. You need to use amounts in New Zealand dollars NZD when filing your income tax return.

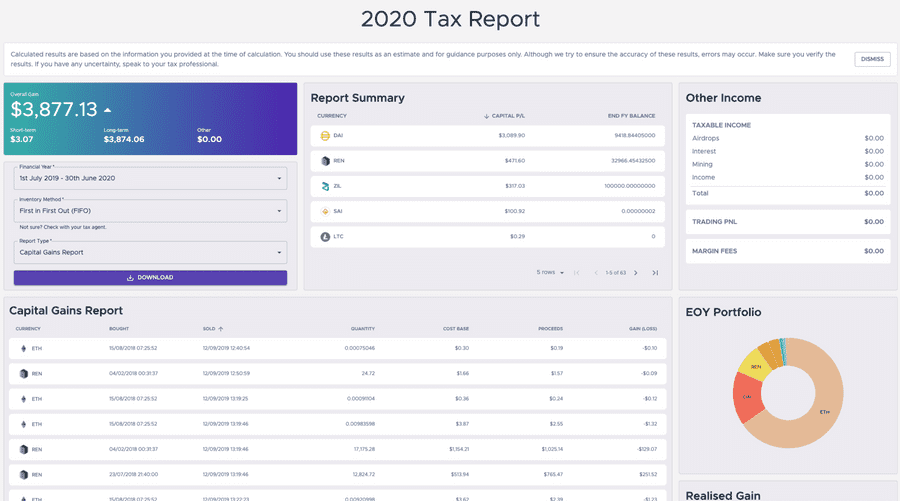

Crypto Tax Calculator 2021 Platform Review

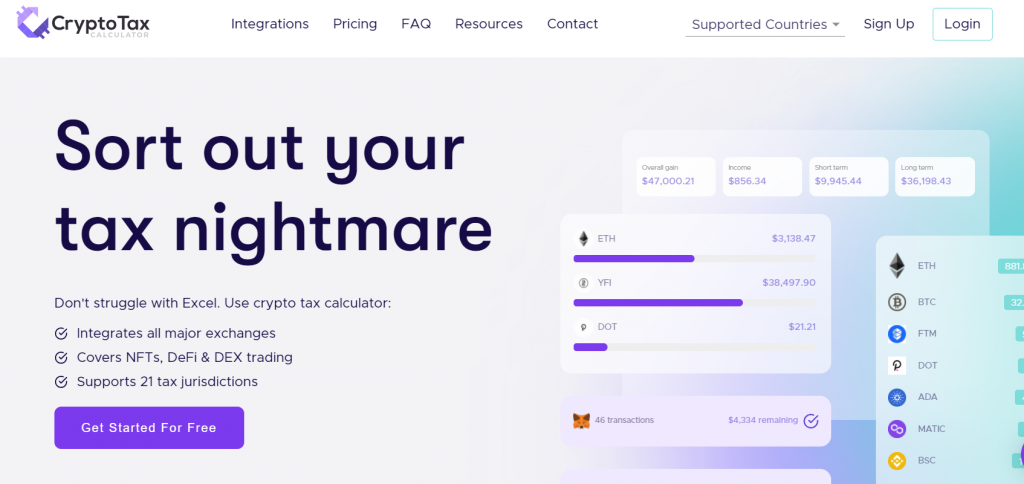

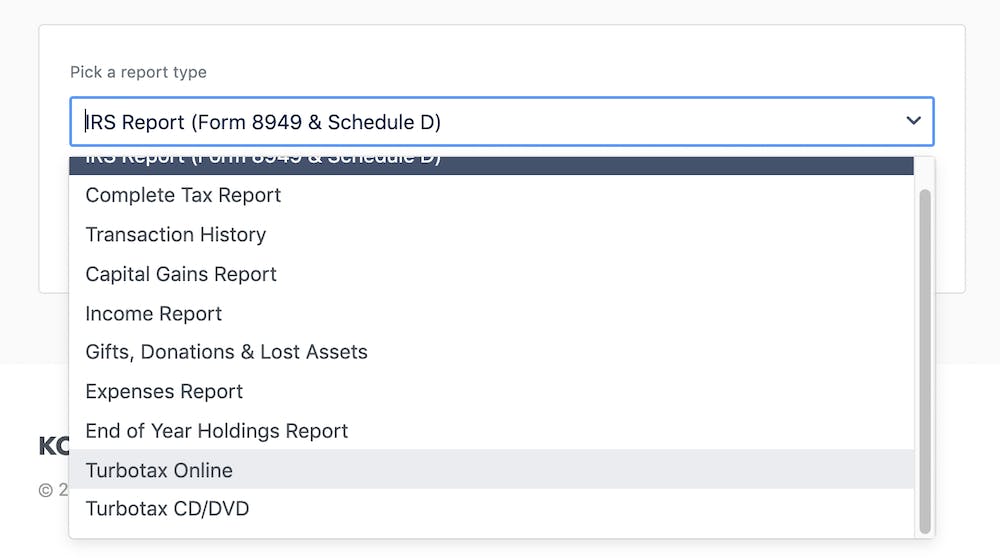

You simply import all your transaction history and export your report.

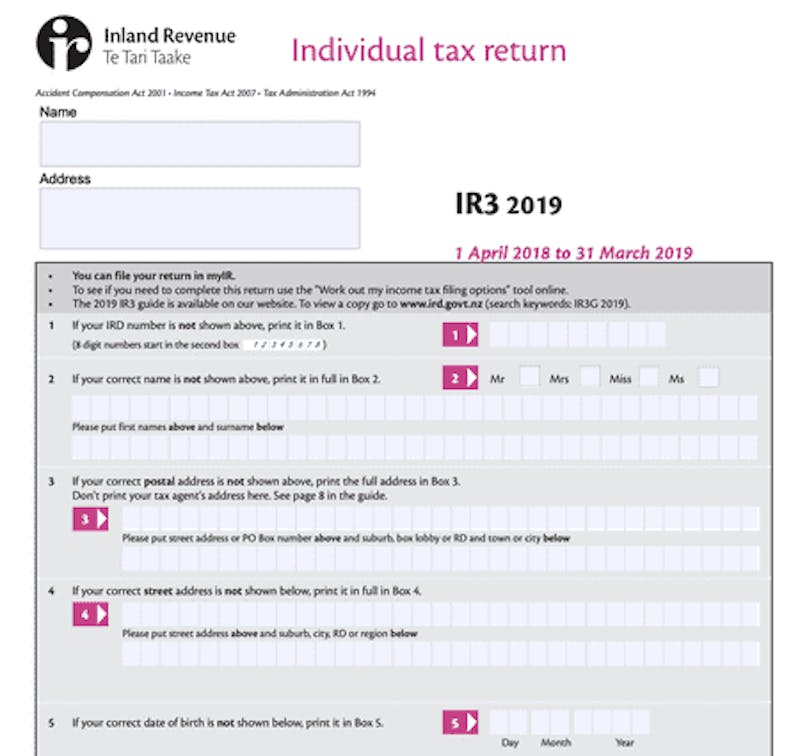

. After the end of the tax year 31 March you need to file an IR 3. Cryptoassets and tax residence. Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz.

In this you include all of the income you have made in the year from all sources including wages dividends cryptocurrencies etc and all of the tax you paid. Exchanging your cryptoassets for different cryptoassets. Using crypto to purchase goods or services is a taxable event.

It does not depend on what they are called. Record keeping for cryptoassets. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

Taxoshi NZs Crypto Tax Caluclator. Refer to the differences in tax payable in example 3 and 4 below. File your crypto taxes in New Zealand.

We have a list of certified tax accountants in New Zealand that specialize in cryptocurrencies. Some cryptoasset transactions may not have an NZD value such as. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income.

GST goods and services tax However as the service is provided to a blockchain digital ledger outside of New Zealand it will be zero rated. There are further rules you need to be aware of if your cryptoassets are trading stock. Our step by step wizard and cryptocurrency tax calculator is fine-tuned for New Zealand and will help you figure out your crypto tax position to declare.

Calculate and report your crypto tax for free now. Receiving a payment in cryptoassets. Without knowing an individuals total income from all sources we cannot calculate how much tax there is to pay because it depends on the individuals total income not just crypto income.

Eligible for a 4-year temporary tax exemption. Work out your cryptoasset income and expenses. Coinpanda generates ready-to-file.

Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position. Sign In with Google. A If you are a tax resident.

B If you are new or returning tax resident after 10 years. Youll need to work out the NZD value of the cryptoassets. In most cases cryptoassets you get from mining such as transaction fees and block rewards are taxable.

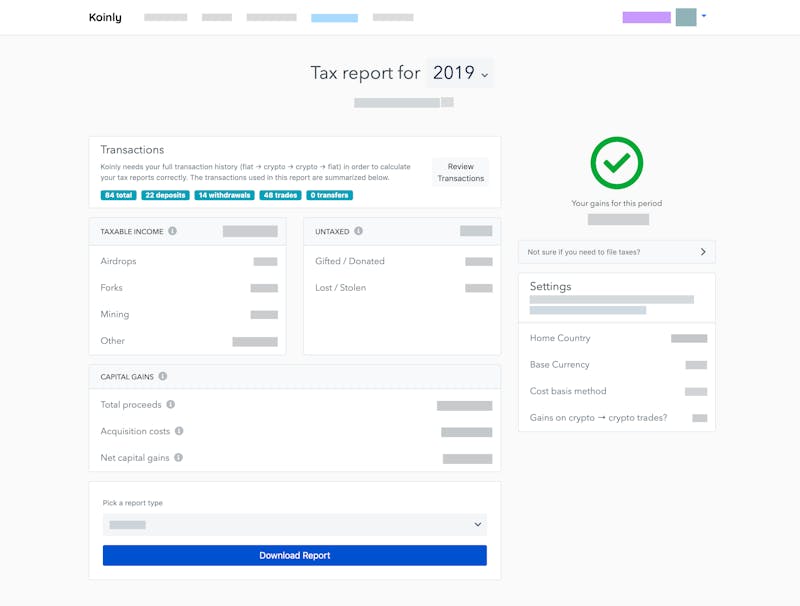

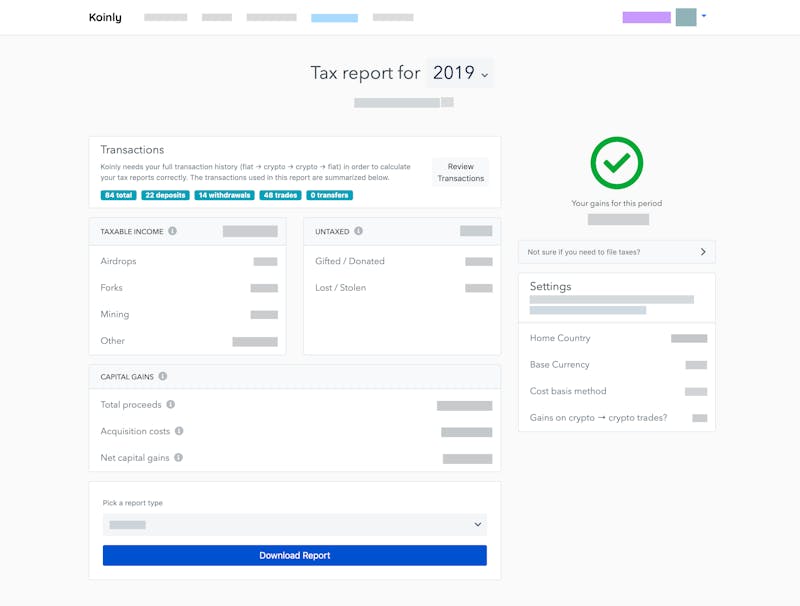

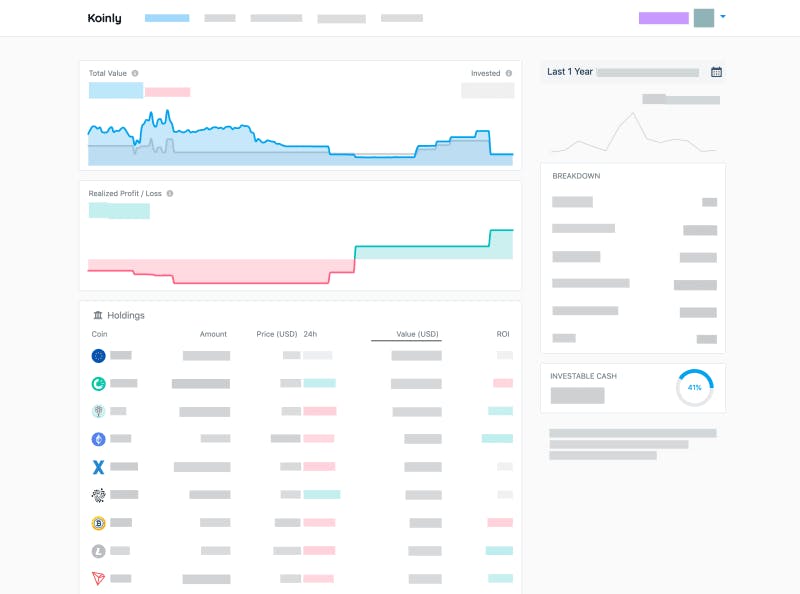

Contact us to ensure you are prepared for tax and have the right strategy in place. Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc. Generate ready-to-file tax forms including tax reports for Forks Mining Staking.

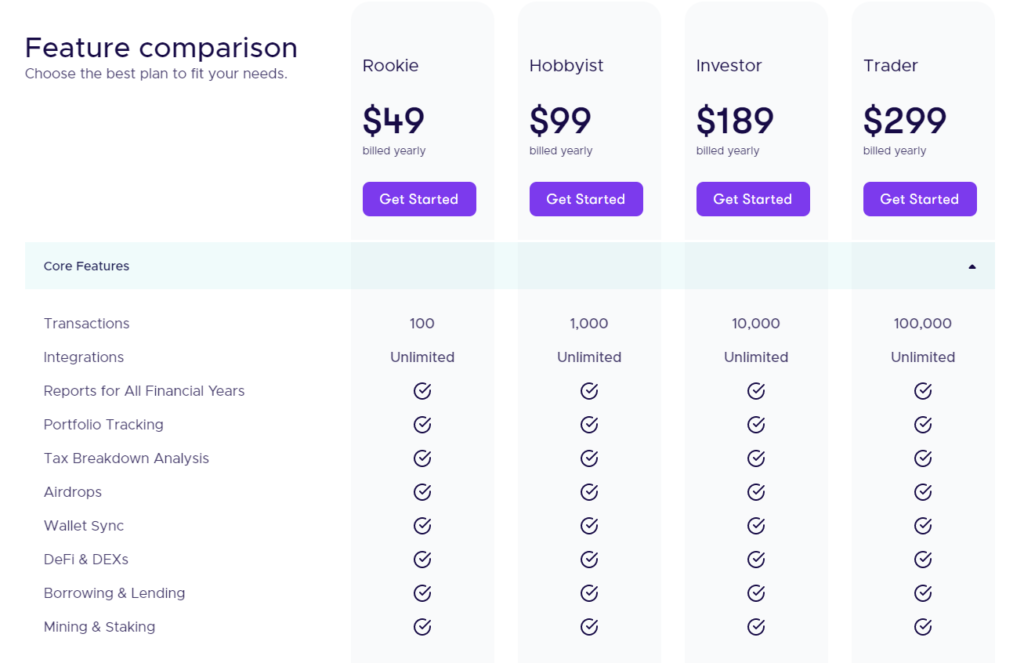

Our subscription pricing is per year not tax year so with an annual subscription you can calculate your crypto taxes as far back as 2013. The mining service you provide will be subject to GST. Crypto CPAs in New Zealand.

This means you can get your books up to date yourself allowing you to save significant time. You need to file a tax return when you have taxable income from your cryptoasset activity. Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax calculation service that makes it easy for you to meet your NZ Crypto tax obligations.

We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. Calculate the New Zealand dollar value of your cryptoasset transactions. Capital gains tax report.

An unrealised profit is when the market value of a token is higher than the original. Mining cryptoassets and tax. With the end of tax year coming up on the 7th of July next month Taxoshis automated.

Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event. Coinpanda lets New Zealanders calculate their capital gains with ease. Miningstaking Income report.

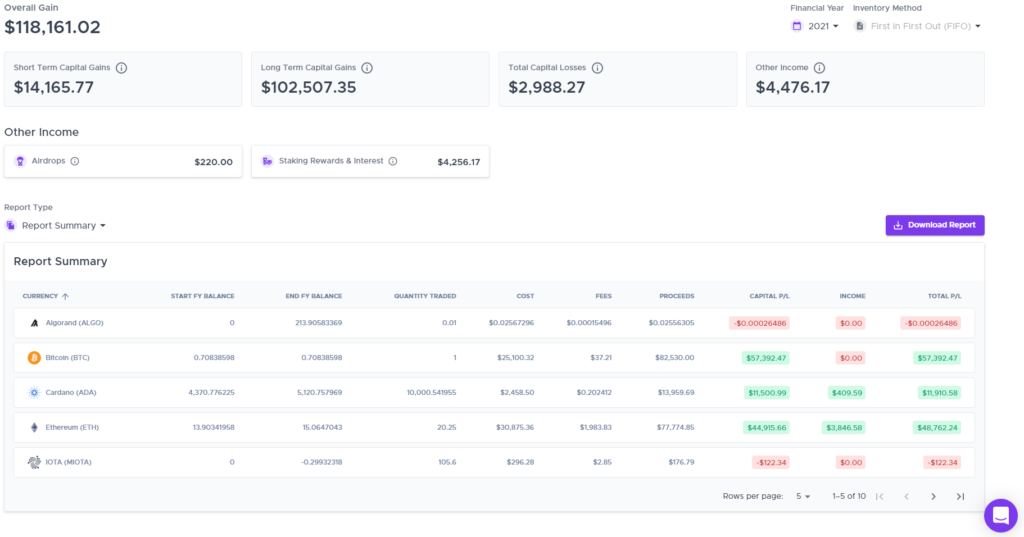

Income report - Mining staking etc. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Before you can put your cryptoasset net income or loss in your tax return you need to.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Cryptoassets are not subject to GST when they are bought or sold but do have GST implications when they are received as payment for normal business activities. Calculate the New Zealand dollar value of your cryptoasset transactions.

Buying crypto is not a taxable event see example 2 below. See our 500 reviews on. While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets.

Or Sign In with Email. Crypto Tax Calculator is a tax tool that can help you create accurate tax reports. Citizens from New Zealand have to report their capital gains from cryptocurrencies.

The table below shows the different tax rate for each income bracket. Receiving mining or staking rewards. Taxed on worldwide income including cryptoasset income from overseas.

Cryptoassets and GST goods and services tax You need to work out your cryptoasset income and expenses before you can work out your net income or loss for your income tax return. The form then helps you calculate if you have paid too much tax or not enough. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance.

Crypto Tax Calculator 2021 Platform Review

Cryptocurrency Taxes What To Know For 2021 Money

Crypto Tax Calculator 2021 Platform Review

Crypto Tax Calculator Review May 2022 Finder Com

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

Crypto Tax Calculator Review And Best Alternatives Crypto Listy

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Crypto Tax Calculator Review And Best Alternatives Crypto Listy

Cryptotaxcalculator Io Review Pricing Supported Exchanges Wallets Countries

Capital Gains Tax Calculator Ey Us

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Koinly Crypto Tax Calculator For Australia Nz

Koinly Crypto Tax Calculator For Australia Nz

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Crypto Tax Calculator 2021 Platform Review

Crypto Tax Calculator Review And Best Alternatives Crypto Listy

Crypto Tax Calculator Review May 2022 Finder Com

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money